How the New U.S. Tariffs Affect You as a Barefoot Shoe Consumer | Updated August 2025

Most barefoot shoes are not made in the U.S. Thus, the new U.S. tariffs and the suspension of the de minimis treatment could have a significant impact on the pricing and availability of barefoot shoes for US consumers.

Back in April 2025, President Donald Trump rolled out a sweeping set of import tariffs, quickly dubbed the “Liberation Day” tariffs. Starting April 5, a flat 10% duty was added to all imports, with even higher rates for certain countries. The announcement stirred up a lot of uncertainty in the months that followed, but by August a handful of trade deals had settled things down.

One of the most significant updates in August is the suspension of de minimis treatment for ALL countries starting August 29, 2025, which allowed goods valued under $800 to enter the U.S. duty-free.

Because most barefoot shoes are made and shipped from outside the U.S., many barefoot shoes will be subject to import tariffs when they are imported into the United States.

August 29 update: The end of the de minimis exemption went into effect, but that evening, the U.S. appeals court ruled that most of the new tariffs are illegal. The court allowed the tariffs to remain in place through October 14 to give the Trump administration a chance to file an appeal with the U.S. Supreme Court. That means orders now through October 14 will still be subject to tariffs.

Tariff Rates as of August 2025

Here are the tariff rates as of August 2025 that are most relevant for barefoot shoe shoppers in the U.S.:

- China: 30%

- Mexico: 25%

- Vietnam: 20%

- European Union: 15%

- UK: 10%

These rates are still subject to change as trade negotiations continue and short-term truces expire. The EU and UK numbers appear to be more settled, but tariffs on imports from China are set to increase on November 10, 2025.

You can find full details in the official documents here:

- White House Press Release

- Annex I Tariff List (PDF)

- July Executive Actions explanation from Gibson Dunn

This post isn’t about debating the pros or cons of the policy. My goal is to help you understand how these new tariffs might affect U.S.-based consumers of barefoot shoes—and what to watch for in the coming months. It can be a difficult process to order barefoot shoes online, and I want you to have a heads up on how that process or the prices could change.

The Suspension of the De Minimis Exemption: What Changed?

The de minimis exemption allows goods valued under $800 to enter the U.S. duty-free, which is why many U.S. customers haven’t paid import taxes on international barefoot shoe orders.

Previously, if you ordered barefoot shoes from China, Vietnam, or the EU—so long as they cost under $800—you avoided tariffs. You may have heard Canadians or Brits post-Brexit sharing their dismay over the high import tariffs they directly have to pay–and now the US is in the same boat.

What Changed in April 2025

The U.S. removed the de minimis exemption for goods shipped from China and Hong Kong. This went into effect on May 2, 2025. This means:

- All goods made in China, regardless of order value, are now subject to a 30% tariff or a $25 per-item fee (increasing to $50 per item after June 1, 2025).

What Changed in August 2025

Effective August 29, 2925, the U.S. will suspend de minimis treatment for ALL countries, meaning all imports, regardless of value or origin, will be subject to standard tariffs and customs processing based on their country of origin.

Key Impact

Because most barefoot shoes are made and shipped from outside the U.S., many barefoot shoes will be subject to import tariffs when they are imported into the United States. If you’re buying from a brand or retailer based abroad, you’ll likely be responsible for paying these fees when your order arrives.

For brands or retailers that import shoes into the U.S. first (like Vivobarefoot or Groundies), you won’t have to pay the tariff directly, but you may see prices increases as those brands adjust to higher import costs.

U.S.-Based Barefoot Shoe Brands and the Tariff Impact

All of these brands are either U.S.-based or have a warehouse here, which means the company (not the customer) is responsible for paying the tariff when they import their shoes. So the retail price you see should already reflect that cost.

I’ve grouped the brands by location simply to give you a sense of what tariffs they may be dealing with. Some companies manufacture in more than one country, but I listed them under the place where production is most common. See the full list of barefoot shoe brands based in the USA here.

Brands Manufacturing in China

China is subject to the 30% tariff.

- Xero Shoes

- Lems

- Splay: KELLY10 for 10% off

- Whitin

- Saguaro: Code KELLY15 for 15% off

- Ten Little Kids

- Reima Kids

Brands Manufacturing in Vietnam

Vietnam is an increasingly popular location to manufacture shoes. Brands manufacturing here include:

- Vivobarefoot: Code BSGVIVO15 for 15% off

- Rutsu

- Tolos

- Altra

- Flux

Brands Manufacturing in Mexico

Mexico is now subject to a 25% tariff rate. These brands currently manufacture there:

Brands Manufacturing in the E.U.

These are E.U.-based brands that have set up a warehouse in the United States, so your order is shipped from within the U.S. The applicable tariffs were paid when the brand first import their shoes into the country, so you should not receive a separate tariff bill.

- Groundies US

- Vivobarefoot: Code BSGVIVO15 for 15% off

Brands Manufacturing in the U.S.

There are a handful of barefoot brands that manufacture their shoes domestically (many of them are hiking sandals). However, many U.S.-made shoes still rely on imported components. For example, Vibram soles—used by many barefoot brands—is an Italian company with products manufactured in Italy, Brazil, China, and the Czech Republic, meaning tariffs may still apply depending on sourcing. But, if you want to avoid any surprise tariff bills or support local manufacturing, check out this full list of barefoot shoes made in the USA.

E.U. Based Brands

Since so many barefoot shoe brands are based in the EU, this is where U.S. shoppers will feel the biggest impact. Without the de minimis exemption, tariffs now apply to orders placed directly with these brands.

Here’s how it might look in practice:

Not collected at checkout: The shipping carrier will bill you instead. Sometimes they’ll contact you before delivery to arrange payment; other times they’ll deliver the package first and send you an invoice afterward.

DDP (Delivered Duties Paid): The brand collects the tariff at checkout, and you’ll see it as a separate line item.

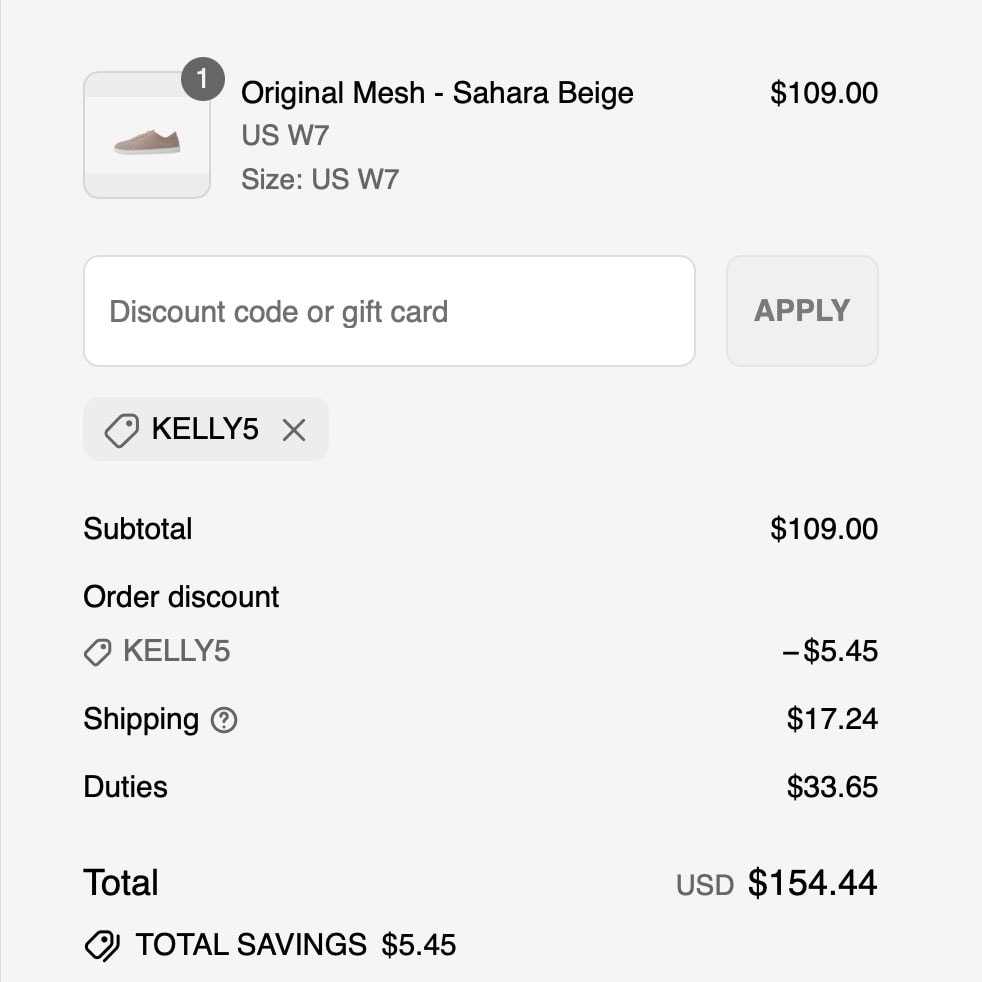

For example, Feelgrounds has chosen to ship DDP, which means at check out the duties are included (see below). While the EU is subject to a 15% tariff, the higher amount may be due to the fact that Feelgrounds’ shoes are manufactured in Vietnam, which has a higher 20% tariff rate. Tariffs are typically based on the country of origin (where the shoe is manufactured), not where the brand is headquartered or where the warehouse is located.

Here are some of the popular E.U. based barefoot shoe brands where you’re mostly to order directly and get your shoes shipped from the E.U.

- Ahinsa

- Brambas

- BeLenka

- Blusun

- Bohempia

- Dolfie Paradise

- Fleeters

- Groundies EU

- Lang.S

- Magical Shoes

- Mukishoes

- Ohne Project

- Shapen

- Skinners

- Wildling EU

U.S. Retailers That Stock EU/UK Brands

There are currently a few online and brick-and-mortar retailers based in the US that purchase from EU and UK-based brands. For example, PedTerra is an online retailer that imports shoes in bulk from EU/UK brands such as Be Lenka, Freet, Peerko, Ahinsa, Mukishoes, and more. Since these orders are now subject to tariffs, retail prices may increase to offset those costs. Use code KELLY for 10% off at PedTerra.

Potential Impacts for U.S. Consumers

Price Increases

Tariffs create uncertainty. Brands may raise prices, reduce production, or delay new releases. Direct costs from tariffs are likely to be passed on to consumers in some form.

Limited Selection or Delays

Brands may cut back on imports from highly impacted regions (like China or Vietnam), leading to lower availability or longer wait times.

Does that mean the shoe price will go up the same as the tariff percentage?

Each business will react this in the way they see fit, but keep in mind that the common markup is often around three times the cost to get to the final retail price. This is because that retail price needs to cover more than just the actual materials and labor that goes into the shoe—it covers all the design, molds, development, marketing, shipping, taxes, etc.

My guess is that some of this cost will be passed on to the consumer, but every brand will determine how to adjust for the impact of these tariffs.

Will Brands Move Manufacturing to the U.S.?

I’ve spent a lot of time talking to brands and am currently working on manufacturing a shoe. Based on my experience researching and going through this process, I think it’s unlikely in the short term. Setting up manufacturing in the U.S. requires:

- Skilled labor

- Equipment

- Training

- Infrastructure

- Long-term capital

Most barefoot shoe brands are still small operations without the resources to make that move quickly. Even for footwear giants, the ability to create and source the infrastructure, equipment and train employees necessary to move manufacturing locations could take years. Even with the final manufacturing taking place in the U.S., the raw materials will be imported and tariffed unless they can be sourced within the US (leather, cotton, synthetics, rubber, metal for buckles, etc). It may happen gradually, but don’t expect a sudden shift.

Key Takeaways

- Biggest Impact: Shoes made in China are now significantly more expensive due to the loss of the de minimis exemption and the new 30% tariffs

- Vietnam tariff settled down to 20% (down from the possible 46% originally proposed. This could still lead to price hikes for brands producing there.

- Tariffs on EU and UK brands are lower, but U.S. customers feel them more since they’re paying the fee themselves on the full retail price when ordering directly.

- US-made shoes may have some impact related to tariffs on key inputs, like Vibram soling.

Final Thoughts

The 2025 tariffs are a major shake-up for almost every industry, and the barefoot shoe industry is no exception. Some brands may adjust manufacturing locations or change how they ship, but the reality is that these changes take time. In the meantime, if you’re a U.S. barefoot shoe consumer, it’s worth keeping an eye on where your shoes are made, how they’re shipped, and how pricing evolves in the months ahead.

3 Comments